Recent U.S. Tariff Policies and Their Impact on the Competitiveness of Taiwanese Fastener Products (2025.11.24 updated)

These findings aim to offer strategic insights to support the future development of Taiwan’s fastener industry.

In light of the rapid and ongoing changes in U.S. tariff policy under the current Trump administration, this report provides an updated summary of the applicable tariff rates on HTS 7318 fastener products exported to the United States from key global suppliers. Furthermore, the analysis examines the impact of recent tariff adjustments on the relative competitiveness of Taiwanese fastener products in comparison with those from competing countries. These findings aim to offer strategic insights to support the future development of Taiwan’s fastener industry.

Outlined below are the current tariff measures affecting exports of HTS 7318 fasteners to the United States:

I. Base Tariff (MFN)

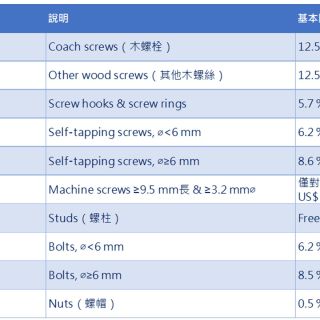

- The Most Favored Nation (MFN) tariff refers to the uniform base import duty applied by the United States (and other WTO member countries) to all countries that are granted MFN or NTR (Normal Trade Relations) status. Regardless of the country of origin, the base tariff for HTS 7318 is determined by its subheading and remains consistent across nations.

For example, “coach screws” are taxed at 12.5%, nuts at 0.5%, etc. Therefore, it is essential to check the specific HTS code to determine the applicable MFN tariff.

- However, certain countries that have signed Free Trade Agreements (FTAs) with the United States may enjoy full tariff exemption or significant reductions, provided that the product meets the rules of origin (e.g., originating from Canada or Mexico). These countries include:

- USMCA (United States–Mexico–Canada Agreement): Canada, Mexico

- CAFTA-DR (Dominican Republic–Central America Free Trade Agreement): Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Nicaragua

- Georgia Free Trade Agreements: Singapore, Israel, South Korea, Australia, Jordan, Morocco, Panama, Peru, Colombia, Chile, Bahrain, among others.

The following table shows the base MFN tariff rates for HTS 7318 products, categorized by subheading:

II. Section 232 – A Surtax Imposed in Addition to Base Tariffs

- Since 2018, under Section 232 of the Trade Expansion Act, the United States has imposed additional tariffs of 25% on steel and 10% on aluminum primary materials, citing national security concerns. Initially, these tariffs did not cover derivative products such as fasteners. Several countries—including Japan, South Korea, the European Union, Canada, Mexico, and the United Kingdom—were granted exemptions or quota-based relief.

- On February 8, 2020, the scope of Section 232 was expanded to include certain derivative products, including fasteners and screws. Nevertheless, selected countries (e.g., South Korea, Mexico, Canada, the EU, Japan, Australia, etc.) continued to benefit from temporary exemptions.

- As a result, between February 8, 2020, and March 12, 2025, Taiwanese fastener exports to the United States were subject to the full Section 232 tariffs, placing them at a 25% cost disadvantage compared to exempted competitors such as Mexico, the EU, Japan, and South Korea.

- Effective March 12, 2025, the Trump administration eliminated all previous exemptions and implemented a uniform 25% tariff on steel and derivative products, including HTS 7318 fasteners, from all countries—ending the preferential treatment previously extended to Japan, South Korea, the EU, Canada, Mexico, and the UK.

- Beginning June 4, 2025, the Section 232 tariff rate was further increased to 50% for steel, aluminum, and their derivative products. As of now, the UK is the only country still subject to the lower 25% rate, while all other countries face the full 50% tariff.

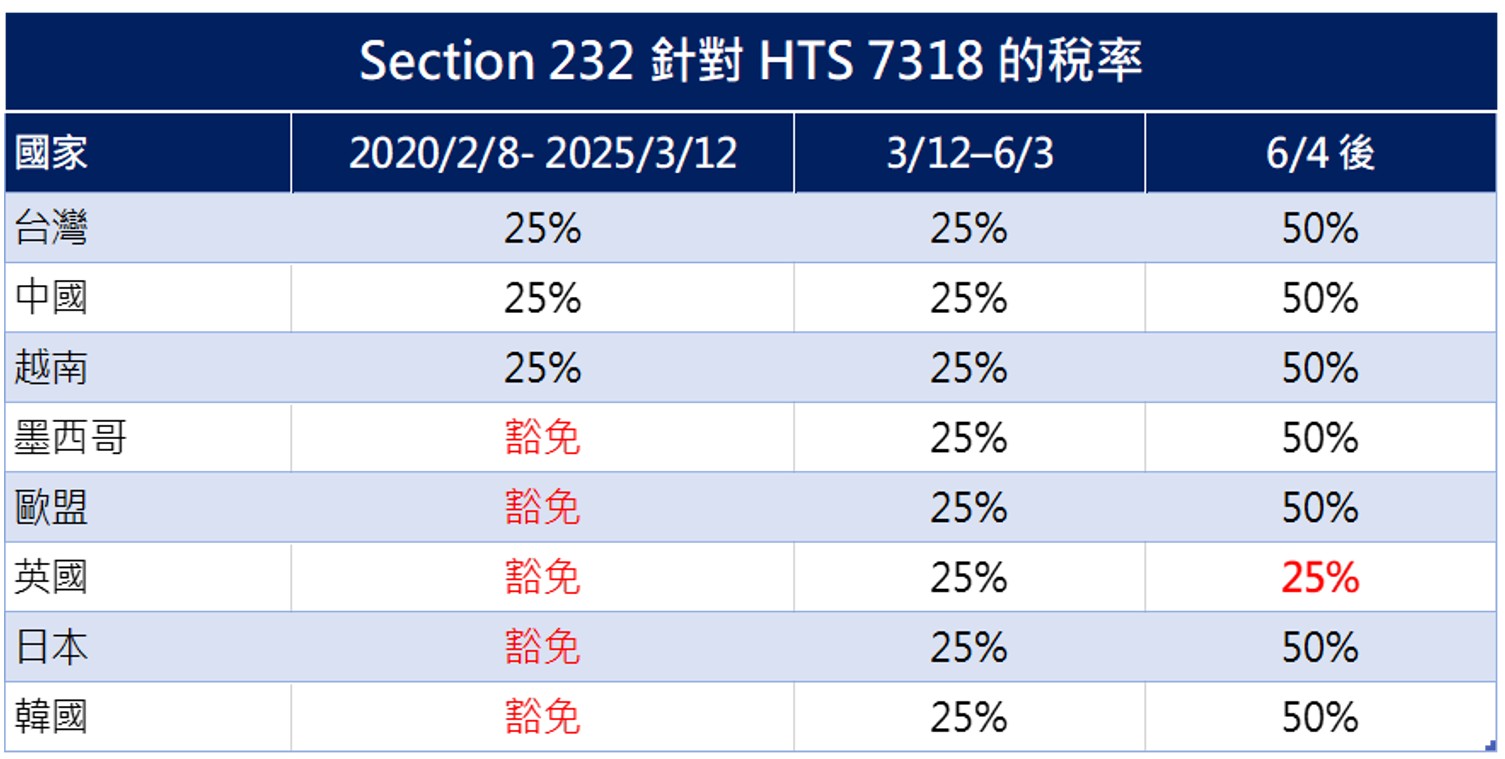

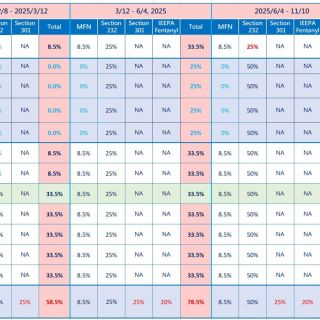

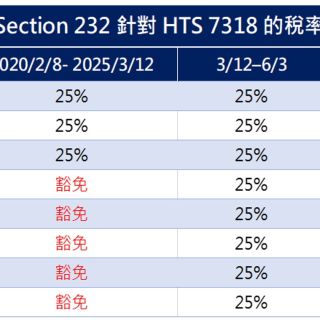

The Section 232 tariff schedule is summarized in the following table:

|

Country |

2020/2/8 – 2025/3/12 |

3/12 – 6/3 |

After 6/4 |

|

Taiwan |

25% |

25% |

50% |

|

China |

25% |

25% |

50% |

|

Vietnam |

25% |

25% |

50% |

|

Mexico |

Exempt |

25% |

50% |

|

EU |

Exempt |

25% |

50% |

|

UK |

Exempt |

25% |

25% |

|

Japan |

Exempt |

25% |

50% |

|

South Korea |

Exempt |

25% |

50% |

III. IEEPA Reciprocal Tariffs – Not Applicable to Steel and Aluminum Derivative Products (Including Fasteners)

-

-

- Since February 8, 2020, steel and aluminum derivative products—including fasteners—have been brought under the scope of Section 232 of the Trade Expansion Act. Consequently, products subject to Section 232 are not additionally subject to the IEEPA Reciprocal Tariffs, which remain a topic of active international debate.

-

-

-

- Section 232 tariffs are applied solely to the steel or aluminum content within a product, rather than its total declared value. However, the non-steel or non-aluminum portions of the product may still be subject to other applicable duties, such as those imposed under IEEPA or other trade remedies.

-

-

-

- It is important to note that Section 232 tariffs are imposed in addition to the Most-Favored-Nation (MFN) base tariff; they are not a replacement. These duties are cumulative.

-

Example: Nylon Insert Nut

Consider a nylon insert nut exported from Taiwan to the United States, classified under HTS 7318. The product consists of approximately 90% steel and 10% nylon by value.

Assuming a total declared value of US$1.00, with US$0.90 attributable to the steel component and US$0.10 to the nylon component, the tariff calculation would be as follows:

|

Tariff Type |

Taxable Value |

Rate |

Duty Amount |

|

Base Tariff (MFN) |

US$1.00 |

0.50% |

US$0.01 |

|

Section 232 Duty |

US$0.90 (steel component)

|

50% |

US$0.45 |

|

Reciprocal Tariff (IEEPA) |

US$0.10 (non-steel part)

|

20% * |

US$0.02 |

|

Total Duty Payable |

US$0.48

|

* Reciprocal tariff based on the provisional IEEPA rate of 20% as of Nov. 24, 2025.

IV. Section 301 & “Fentanyl Tariff” – Applicable Exclusively to China

-

- Since 2018, the United States has imposed Section 301 tariffs on a wide range of Chinese imports, including fastener products classified under HTS 7318.11 through 7318.29 (e.g., screws, nuts, washers). These tariffs are levied at a rate of 25%.

-

- Section 301 duties are imposed as a standalone surcharge, in addition to the base MFN tariff and any applicable Section 232 duties.

-

- In March 2025, under the authority of the International Emergency Economic Powers Act (IEEPA), the U.S. government introduced an additional 20% punitive tariff—commonly referred to as the “Fentanyl Tariff”—targeting imports from China in response to concerns over fentanyl-related substances. * “Following the U.S.–China negotiations in late 2025, the United States reduced the ‘fentanyl tariff’ portion. Starting from November 10, 2025, the 20% emergency surcharge was cut in half to 10%.”

-

- Consequently, Chinese-origin fasteners exported to the United States are currently subject to the following cumulative tariffs:

- MFN Base Tariff – Ranges from 5% to 12.5%, depending on the specific HTS subheading

- Section 232 Duty – 50%, on the steel component of the product

- Section 301 Duty – 25%, applicable exclusively to Chinese goods

- IEEPA “Fentanyl Tariff” – 10%*, for China goods

- Consequently, Chinese-origin fasteners exported to the United States are currently subject to the following cumulative tariffs:

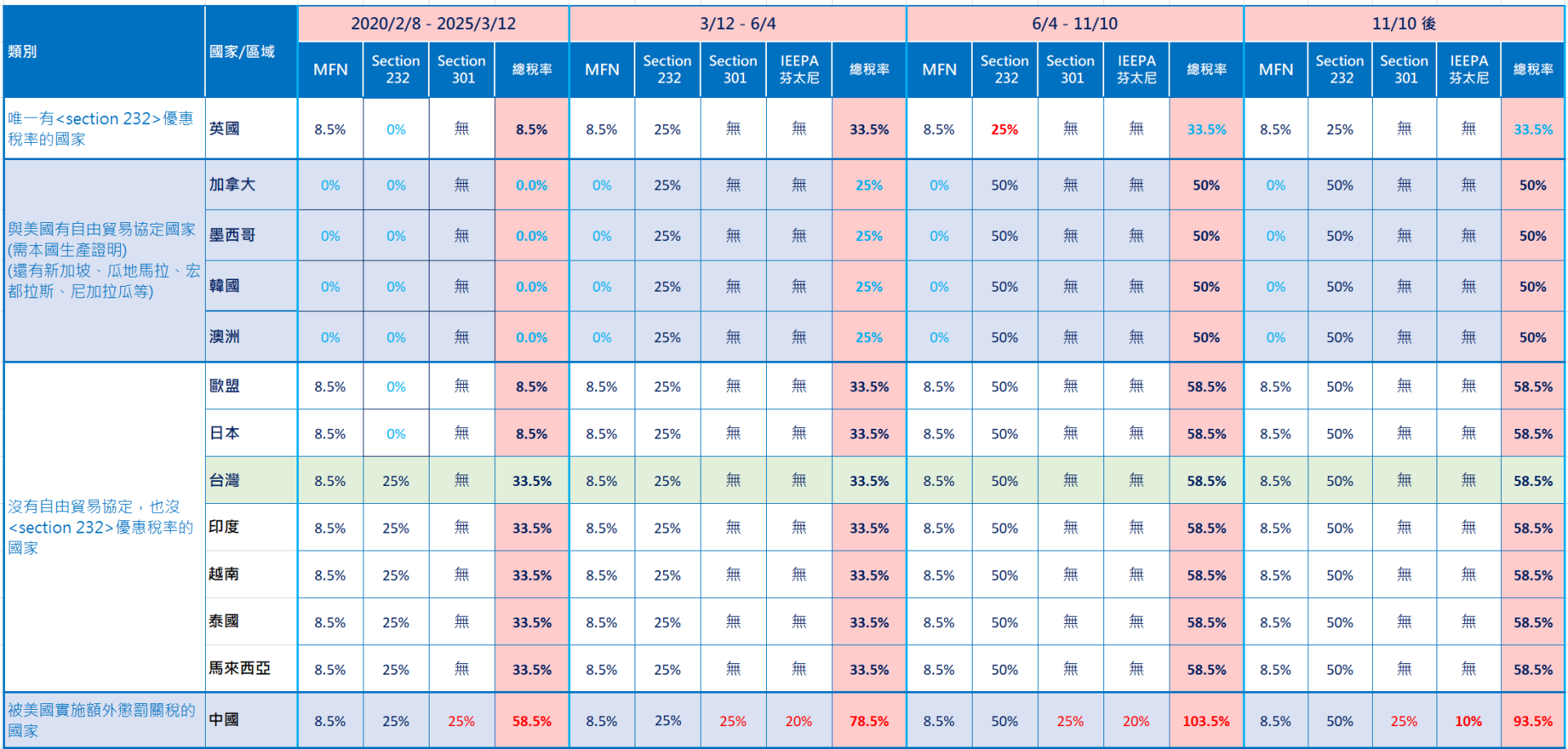

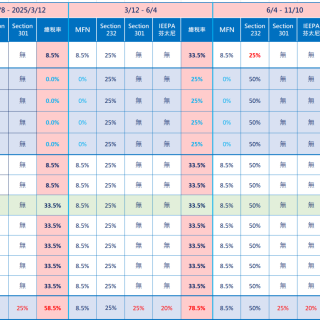

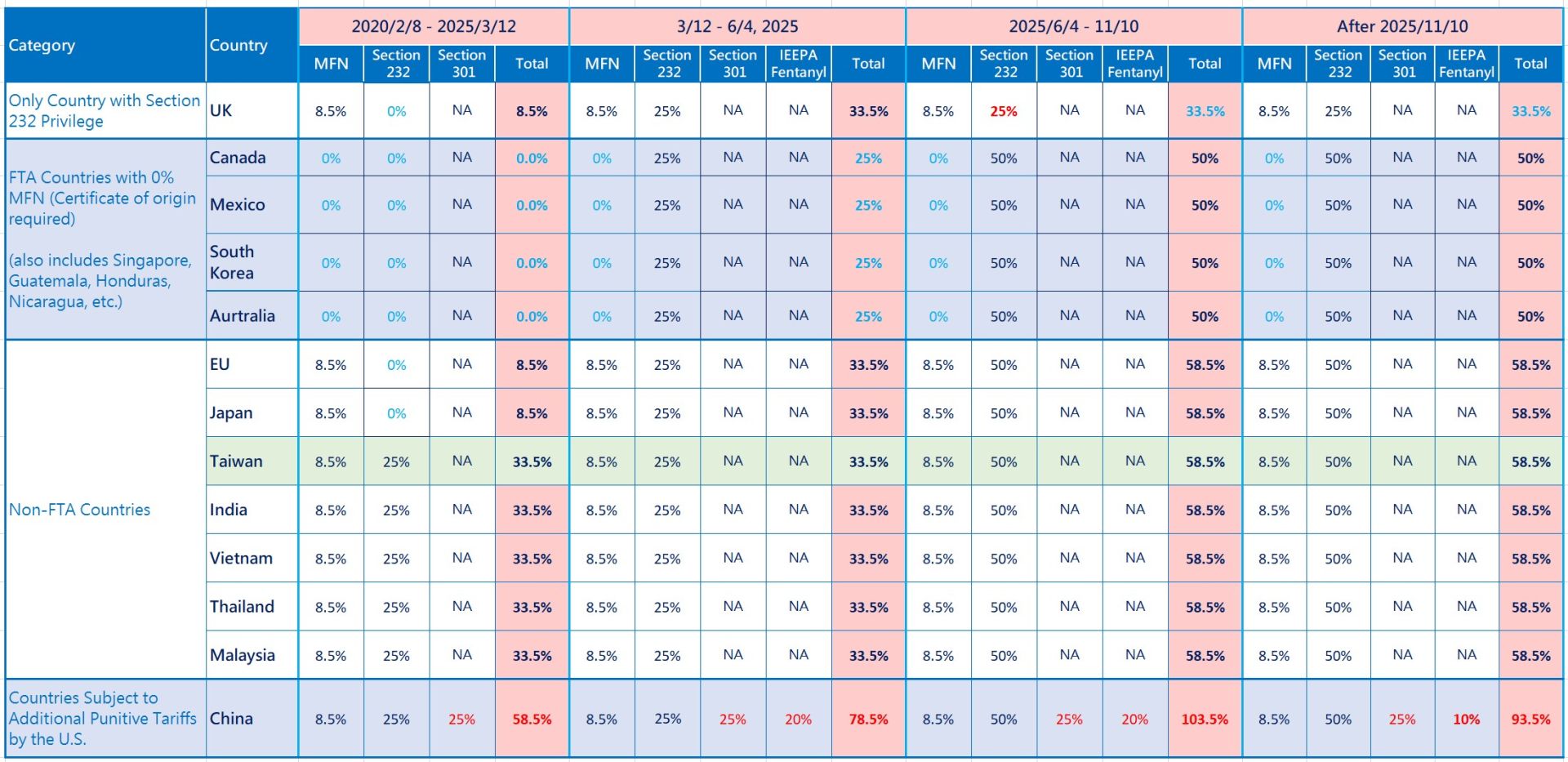

V. Latest Tariff Rates on HTS 7318 Fasteners by Country

The following table provides a summary of the most recent U.S. tariff rates applied to HTS 7318 fastener products imported from various countries.

Given the numerous subheadings under HTS 7318 and the variation in Most-Favored-Nation (MFN) tariff rates—which range from 0% to 12.5%— this analysis uses HTS 7318.15.80.00 (Bolts with a diameter of 6 mm or more) as a representative case. This product is subject to an MFN base tariff of 8.5%.

The table below highlights the tariff rate changes for major exporting countries before and after the Trump administration’s most recent tariff policy update, announced on June 4, 2025:

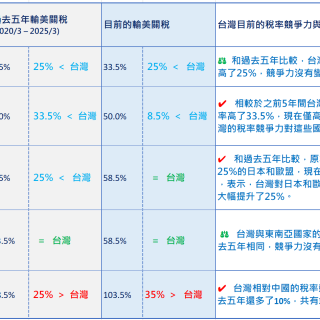

VI. Competitive Shifts in Taiwanese Fastener Exports

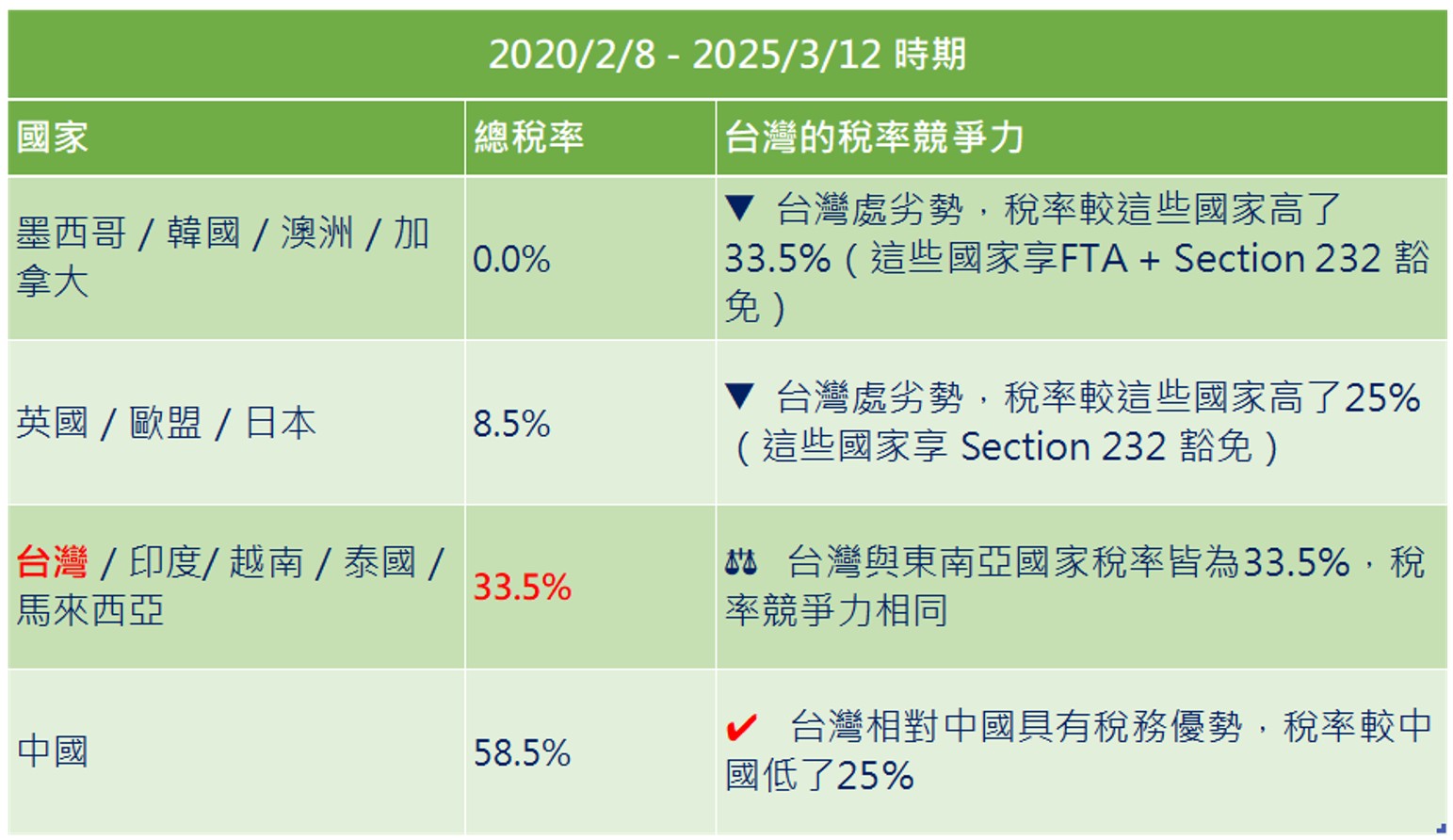

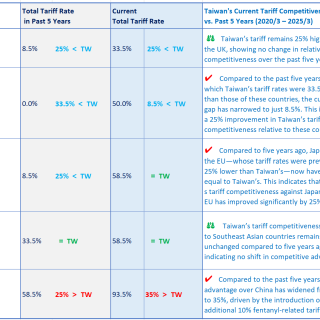

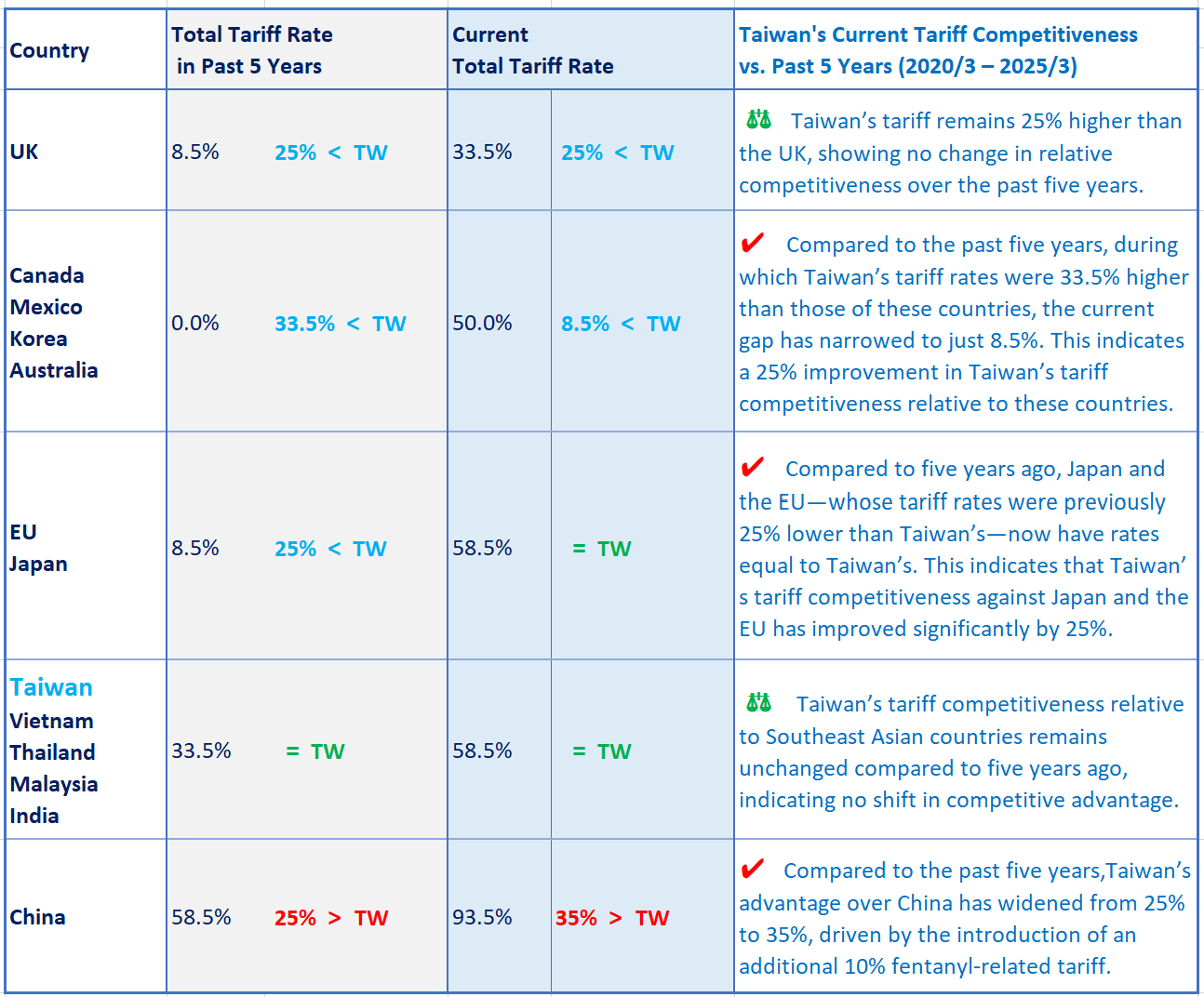

The table below illustrates the tariff-based competitiveness of Taiwanese fastener exports in the U.S. market over the past five years (February 8, 2020 – March 12, 2025), compared to other major exporting countries.

It highlights how shifts in U.S. trade policy—particularly the impact of Section 232 tariffs and the lack of FTA-based exemptions for Taiwan—have affected Taiwan’s relative cost position.

|

Country |

Total Tariff Rate |

Taiwan's Tariff Competitiveness in Past 5 Years (2020/2/8 – 2025/3/12) |

|

Mexico / South Korea / Australia / Canada |

0.0% |

❌ Taiwan was at a disadvantage, with tariffs 33.5% higher than these countries (which enjoyed FTA & Section 232 exemptions).

|

|

UK / EU / Japan |

8.5% |

❌ Taiwan was at a disadvantage, with tariffs 25% higher than these countries (which had Section 232 exemptions).

|

|

Taiwan / India / Vietnam / Thailand / Malaysia |

33.5% |

⚖️ Taiwan's tariff rate was equivalent to those of other key Asian competitors, resulting in a relatively level playing field.

|

|

China |

58.5% |

✔ Taiwan held a competitive advantage over China, with tariffs 25% lower than those applied to Chinese exports.

|

u Over the past five years, Taiwan’s fastener exports to the U.S. faced a tariff rate of 33.5%, second only to China’s 58.5%— a 25% differential.

u Taiwan shared the same tariff level as India, Vietnam, Thailand, and Malaysia, offering no relative advantage.

u In contrast, Taiwan’s tariffs were 25% higher than those imposed on the UK, EU, and Japan, and 33.5% higher than those applied to Mexico, South Korea, Australia, and Canada—countries benefiting from zero tariffs under FTAs and Section 232 exemptions.

u Due to the imposition of punitive Section 301 tariffs, China’s total tariff burden in the U.S. market surpassed that of Taiwan and Southeast Asian countries by 25%, significantly eroding its price competitiveness. As a result, over the past five years, many U.S. importers have gradually shifted their sourcing away from China toward India and Southeast Asia.

u Capitalizing on their 25% tariff advantage over China and comparatively lower labor costs, India and Southeast Asia have attracted increasing numbers of fastener manufacturers from both China and Taiwan to establish local production operations. These regions have since evolved into emerging hubs for fastener manufacturing.

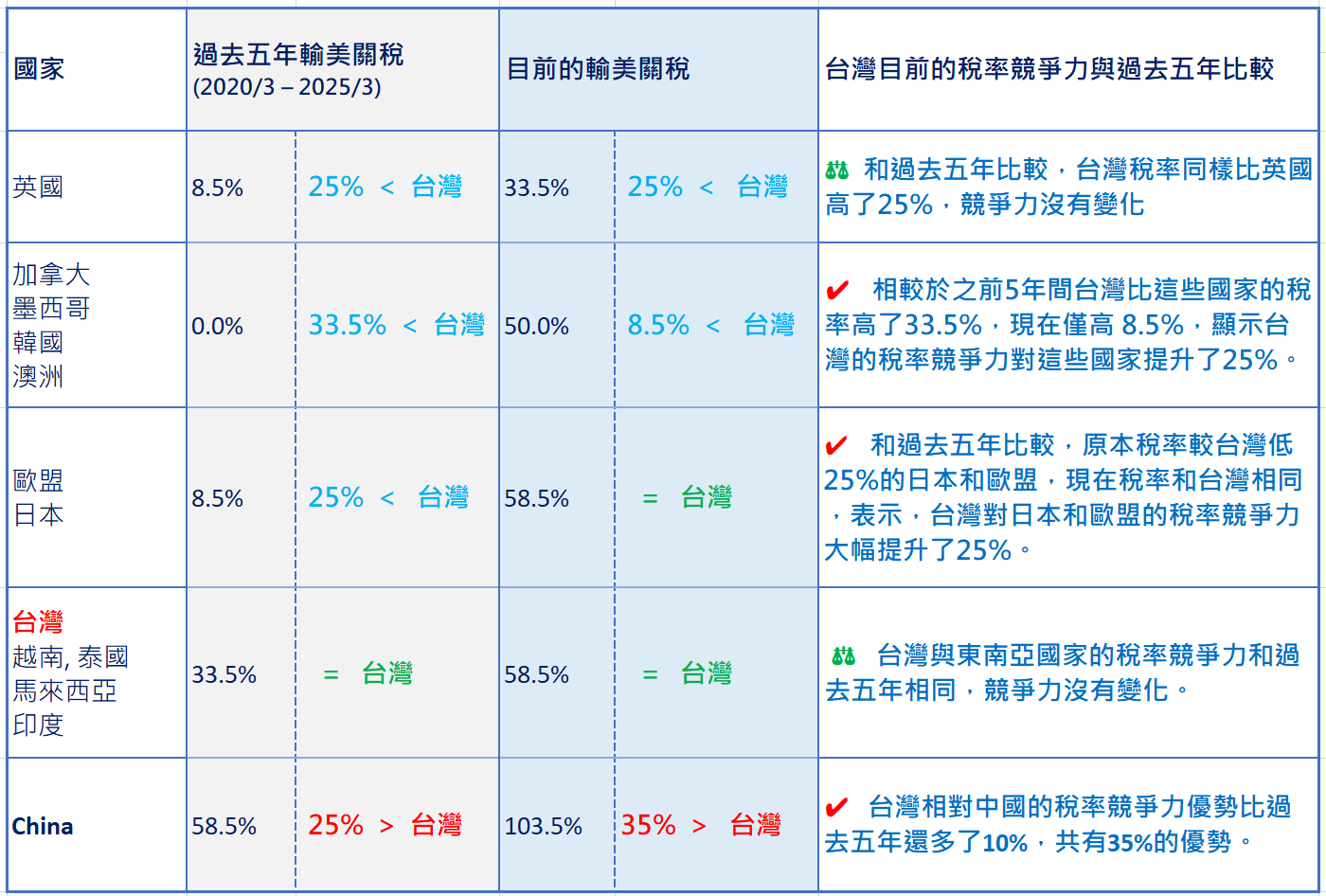

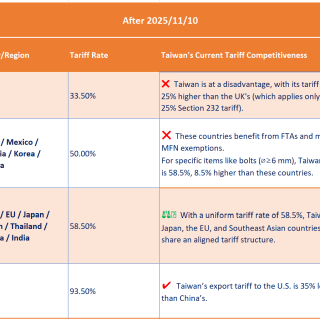

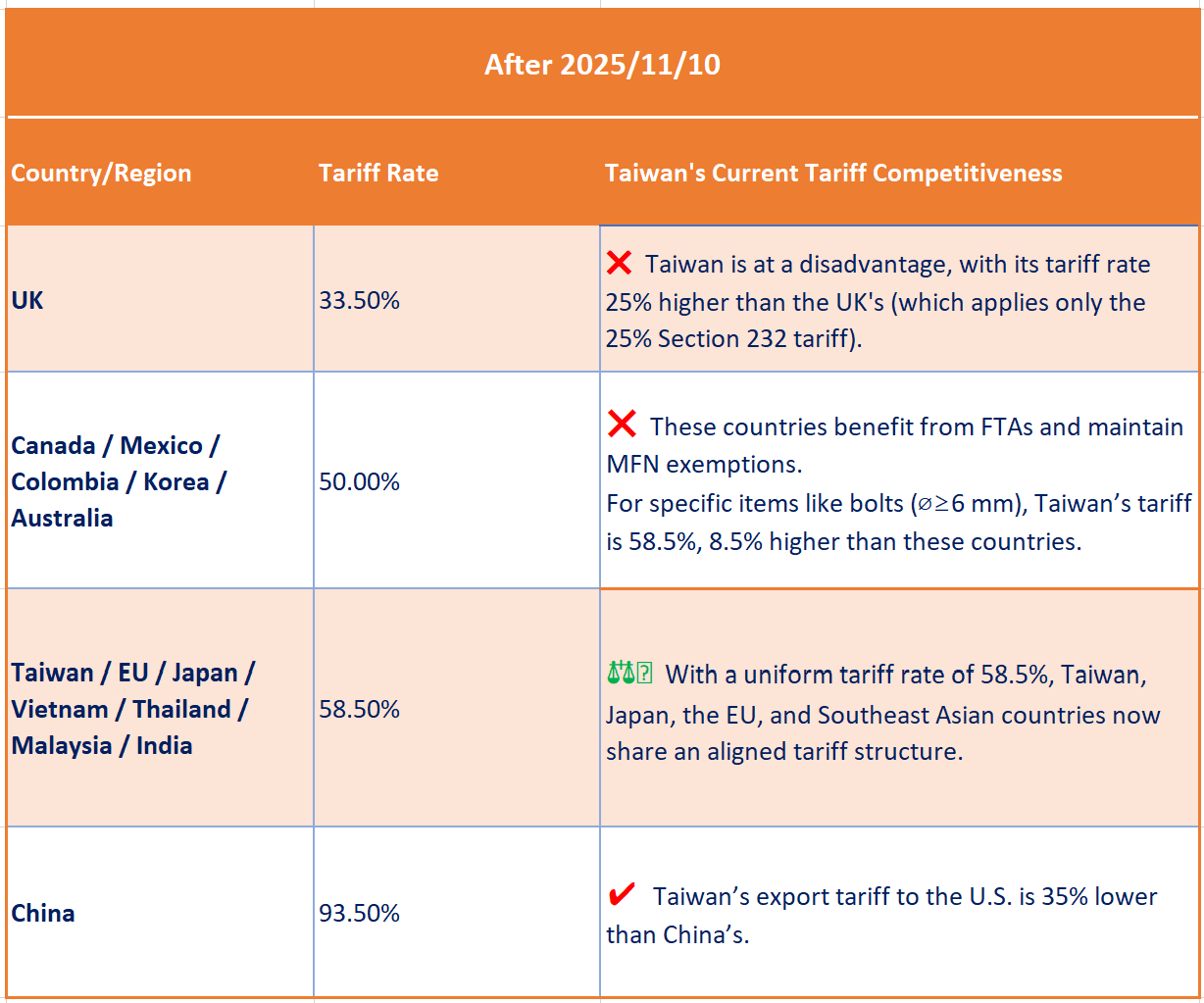

The table below presents a comparison of the latest U.S. tariff rates (as announced on November 10, 2025), along with an analysis of the resulting changes in competitiveness.

• UK

As shown in the table above, Taiwan’s current tariff base is 58.5%, which is 25% higher than the UK’s 33.5%. However, since the UK is not a major exporter of fasteners and there is limited product overlap with Taiwan, the impact is minimal.

• Southeast Asian countries (Vietnam, Thailand, Malaysia) and India

For both the past five years and now, these countries share the same tariff base for exports to the U.S., which has increased from 33.5% to 58.5%. Although the base has risen by 25%, the increase applies to all exporting countries equally, meaning the competitive footing remains unchanged and there is no shift in relative competitiveness.

• China

Over the past five years, Taiwan’s export tariff to the U.S. for fasteners was 33.5%, 25% lower than China’s 58.5%. Currently, Taiwan’s rate has increased to 58.5%, while China’s has surged to 93.5%, giving Taiwan a 35% tariff advantage. This marks a significant improvement in Taiwan’s price competitiveness.

Furthermore, under the current U.S. policy direction of “de-risking from China,” American buyers are actively seeking to shift away from Chinese-origin products. As a result, Taiwan, along with Vietnam and India, has become a likely alternative sourcing option. This trend presents a major opportunity for Taiwan’s fastener industry.

• Mexico, South Korea, Canada, and Australia

In the past five years, these countries enjoyed both Section 232 tariff exemptions and FTA benefits with the U.S., resulting in a 0% tariff rate—giving them a significant advantage over Taiwan’s 33.5% rate at the time. However, with the recent removal of the Section 232 exemption, they now only benefit from MFN (Most Favored Nation) base tariff exemptions.

For example, under HTS code 7318.15.80.00 (Bolts, ⌀ ≥ 6 mm), the current tariff rate is 50%, which is just 8.5% lower than Taiwan’s 58.5%. Compared to their previous 33.5% advantage, the gap has narrowed by 25%. This shift further strengthens Taiwan’s relative competitiveness in the U.S. market.

• European Union and Japan

Over the past five years, both the EU and Japan benefited from Section 232 tariff exemptions, resulting in a reduced tariff rate of only 8.5%, which was 25% lower than Taiwan’s 33.5% rate at the time. However, with the recent removal of their Section 232 exemptions, their current tariff base for exports to the U.S. has increased to 58.5%—the same as Taiwan’s.

This change eliminates Taiwan’s previous disadvantage in tariff competitiveness relative to the EU and Japan. As a result, Taiwan’s tariff position has improved by 25%, representing a significant positive development for the Taiwanese fastener industry.

Conclusion

• Current Situation in the Fastener Industry:

At present, the United States imposes a uniform 50% Section 232 tariff on fastener imports from all countries— except the UK, which is subject to a 25% rate. As a result, U.S. importers face a substantial cost increase of 50% regardless of their sourcing country.

While some U.S. buyers may consider sourcing domestically to avoid the 50% tariff, this is only feasible if U.S. domestic prices are lower than the landed cost of imported fasteners with the tariff included.

However, given the current industrial structure in the U.S., along with higher labor and production costs, domestic fastener suppliers struggle to offer more competitive pricing. Consequently, U.S. importers still rely heavily on foreign sources for the majority of fastener imports.

Under these circumstances, Taiwanese fastener exporters should focus less on the absolute tariff rate imposed on their products and more on how their tariff-adjusted prices compare to those of key competitors. The primary consideration should be Taiwan’s relative price competitiveness within the global fastener supply landscape.

• Shift of Orders from China:

Due to punitive tariffs imposed by the United States on Chinese products—namely a 25% Section 301 tariff and an additional 10% fentanyl-related tariff, totaling 35%— China’s price advantage has been significantly eroded.

As U.S. importers are now burdened with these high duties, the competitiveness of Chinese-made fasteners in the U.S. market has been severely impacted. Moreover, quality consistency issues in Chinese fasteners, particularly in comparison to Taiwan’s high-end products, have further motivated U.S. buyers to seek alternative suppliers. This creates a valuable opportunity for Taiwanese fastener manufacturers to capture redirected orders previously destined for China.

However, Taiwan must also evaluate its price competitiveness in the low- and mid-end product segments, especially against countries like Vietnam and India. If Taiwan cannot offer a clear pricing advantage in these segments, there is a high likelihood that the diverted orders from China may instead shift toward Southeast Asia and India

• High-End Fasteners – Strategic Opportunities for Taiwan:

In the future, Taiwanese fastener manufacturers may consider actively competing in the U.S. high-end fastener market—particularly against mainstream fastener products from the EU, Japan, Mexico, South Korea, Canada, and Australia—since Taiwan’s tariff-related price disadvantage compared to these countries has narrowed by more than 25% over the past five years.

For example, as of June 4, 2025, Taiwan now faces the same tariff rate as the EU and Japan when exporting fasteners to the U.S., eliminating any previous tariff disadvantage.

In comparison to Mexico, South Korea, Canada, and Australia—countries that previously enjoyed Section 232 exemptions and FTA benefits—Taiwan’s current tariff rates are now only 0% to 12.5% higher, depending on the product category under the HTS system:

-

- HTS 7318.16 (Nuts): Only 0.5% higher

- HTS 7318.14 (Self-tapping screws, ⌀ < 6 mm): 6.2% higher

- HTS 7318.11 (Coach screws): 12.5% higher

When combined with Taiwan’s cost-competitive manufacturing structure, this shift in U.S. tariff policy greatly enhances the export pricing competitiveness of Taiwanese fasteners relative to the EU, Japan, South Korea, Canada, and Mexico.

These changes represent a significant strategic opportunity for Taiwan’s fastener industry. Companies should consider this evolving landscape when formulating product development and marketing strategies aimed at the U.S. high-end segment.

__24H06J3Lif.jpg)